Aidrop Live...The First DEX Built

for Ripple's XRP Ledger

$DXP Presale LIVE!

Next price increase in:

DeXRP is a next-generation decentralized exchange powered by the open-source XRP Ledger.

We combine blazing-fast transactions, ultra-low fees, and deep liquidity to deliver an institutional-grade trading experience for everyone — from crypto newcomers to pro traders.

Sep 02, 2025, 08:00pm EDT

DeFi Performance Gap: What's Holding DEXs Back And Who Are Solving It

Decentralized exchanges (DEXs) were meant to embody the promise of DeFi: open, borderless, peer-to-peer markets that couldn't be shut down. They account for 7.6% of the total global crypto trading volume, up from just 3%...

No Noise.

Just Execution

DeXRP strips away the clutter — leaving only pure performance

Features you love

Instant

Settlements

Finalize trades in seconds, not minutes

Low Fees

Keep more of what you earn thanks to XRPL’s efficient design

Dual

Trading Modes

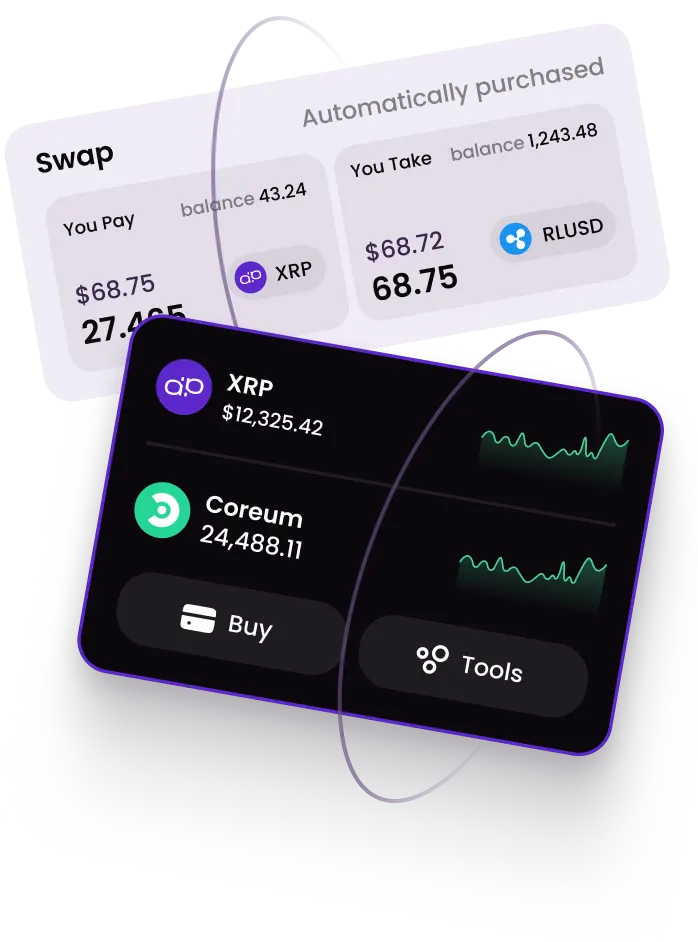

Use AMM for quick swaps or the order book for precise control

Advanced

Order Types

Stay ahead with integrated charts and deep market data

Smart

Liquidity Routing

Get the best price and lowest slippage — every time

For who

Retail Traders

Simple swaps, intuitive interface, and powerful features without complexity

Professional Traders

Advanced orders, real-time analytics, and precision execution at scale

Powered by the open-source

XRP Ledger

Fast and efficient consensus algorithm, with transaction settling in 4 to 5 seconds.

Advanced cryptography ensures superior security.

Censorship-resistant transaction processing.

On-ledger decentralized exchange for maximum transparency.

Partners & Integrations

Calculate the profit

How much do you want to invest?

Slide to set the potential $DXP price after listing

Tokenomics

Public Sale

25%

Liquidity Provision

15%

Staking & Rewards

10%

Ecosystem & Partnerships

10%

Team & Advisors

10%

Marketing & Community

12%

Reserve & Treasury

9%

R&d & Innovation Fund

6%

Airdrop & Bounty Programs

3%

no unlock at TGE: vesting timing can adjust based on campaign cadence (default 12 months)

Explore the DeXRP Roadmap

Q2

2025

Infrastructure

• Finalize DEX core on XRPL.• Integrate AMM + order book with advanced order types.• Complete smart contract audit.

Q3

2025

IDO & Core Features

• $DXP token presale launch.• Deploy LP reward system.• Build advanced order routing.• Set up liquidity control mechanisms.

Q4

2025

Public Launch & Growth

• Release platform for public trading.• Integrate real-time analytics.• Launch fee governance via LP tokens.• Secure initial partnerships and listings.

Q1

2026

Institutional Expansion

• Enable yield multipliers for LPs.• Provide API & Pro trading tools.• Extend routing to external DEXs and sidechains.• Begin onboarding institutional partners.

Q2

2026

Ecosystem Scaling

• Add cross-chain and sidechain support.• Run educational and community campaigns.• Launch global marketing with Ripple ecosystem partners.

Everything

you need

to trade

smarter

Real-Time Analytics Dashboard

Monitor price trends, volume, and liquidity across all pools with an integrated analytics suite.

Dual Trading System

AMM meets Order Book — swap instantly or place precision trades with advanced order types.

Ultra-Fast Settlements

Thanks to XRPL’s architecture, trades are confirmed in seconds with near-zero latency.

Dynamic Fee Control

Liquidity providers influence trading fees in real time via LP token-based auctions.

Advanced Order Types

Limit, stop, and stop-limit orders empower traders to execute strategies with precision.

Smart Liquidity Routing

Optimized algorithms ensure every trade is routed for the best price and lowest slippage.

Regulatory-Ready Transparency

Every transaction is recorded on-chain — no black boxes, just full visibility for all.

Be part of DeXRP from day one

Our IDO offers early access to the native token powering the future of decentralized trading on XRPL.

Insights

Business Insider

DeXRP: A New Chapter for the Ripple Ecosystem

As XRPL’s Total Value Locked soars, the DeXRP team introduces a hybrid DEX model aimed at both retail and institutional users.

Jun 26, 2025

5 min read

CoinMarketCap

DeXRP is Rethinking What a DEX Can Be

Built on XRPL, this next-gen exchange combines AMM and Order Book models — here's why it's turning heads.

Jun 26, 2025

4 min read

Benziga

A Rare Entry Point?

With presale tokens at $0.00525 and a listing price set at $0.35, DeXRP’s IDO offers more than just numbers — it offers vision.

Jun 26, 2025

3 min read

Advfn

A Breakthrough on XRPL

DeXRP, the first-ever decentralized exchange on the XRP Ledger, launches its IDO and sets out to redefine the trading experience for XRP holders.

Jun 26, 2025

4 min read

Cryptopotato

Bridging the Gap Between Institutions and Retail

DeXRP’s dual trading engine, advanced liquidity incentives, and fee auction system are built for every level of trader.

Jun 26, 2025

5 min read

FAQ

Optimized algorithms ensure every trade is routed for the best price and slippage. Lock liquidity with customizable

What makes DeXRP unique compared to other DEX platforms?

DeXRP combines a traditional order book with an advanced AMM engine, offering enhanced trading features, dynamic fee management, and near-instant settlement on the XRPL.

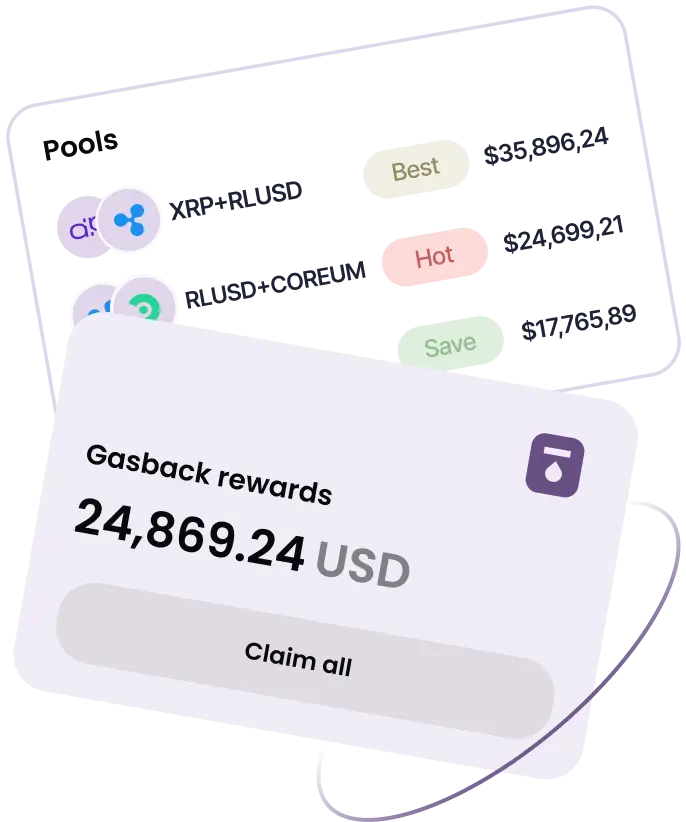

How does the fee and reward system for liquidity providers work?

Liquidity providers receive LP tokens, which allow them to participate in fee auctions for discounted trading slots and influence fee structures through an interactive voting mechanism.

Does the platform support advanced order types like limit and stop orders?

Yes, DeXRP supports limit orders, stop orders, and stop-limit orders, giving users greater control over their trades and risk management.

What tokens are used to reward liquidity providers?

Instead of issuing a separate governance token, DeXRP uses XRPL’s native assets and LP tokens to reward liquidity providers and maintain platform incentives.

Is DeXRP suitable for institutional investors?

Yes, DeXRP offers professional trading tools, real-time market analytics, smart order routing, and full trade transparency designed to meet institutional standards.

How does the platform ensure optimal trade execution?

DeXRP leverages liquidity aggregation and intelligent order routing algorithms to find the best available prices with minimal slippage across liquidity pools.

What additional benefits do liquidity providers receive?

Liquidity providers can adjust yield multipliers based on their lock-in period, allowing for higher returns with longer-term liquidity commitments.